Complete guide to VAT refunds at Suvarnabhumi Airport. Find exact counter location near Gate 10, step-by-step procedure, required documents, and money-saving tips for your tax refund in Bangkok.

Non-permanent resident foreigners are eligible to claim a Value Added Tax (VAT) refund on their purchases in Thailand. Below is a step-by-step guide to help you through the process.

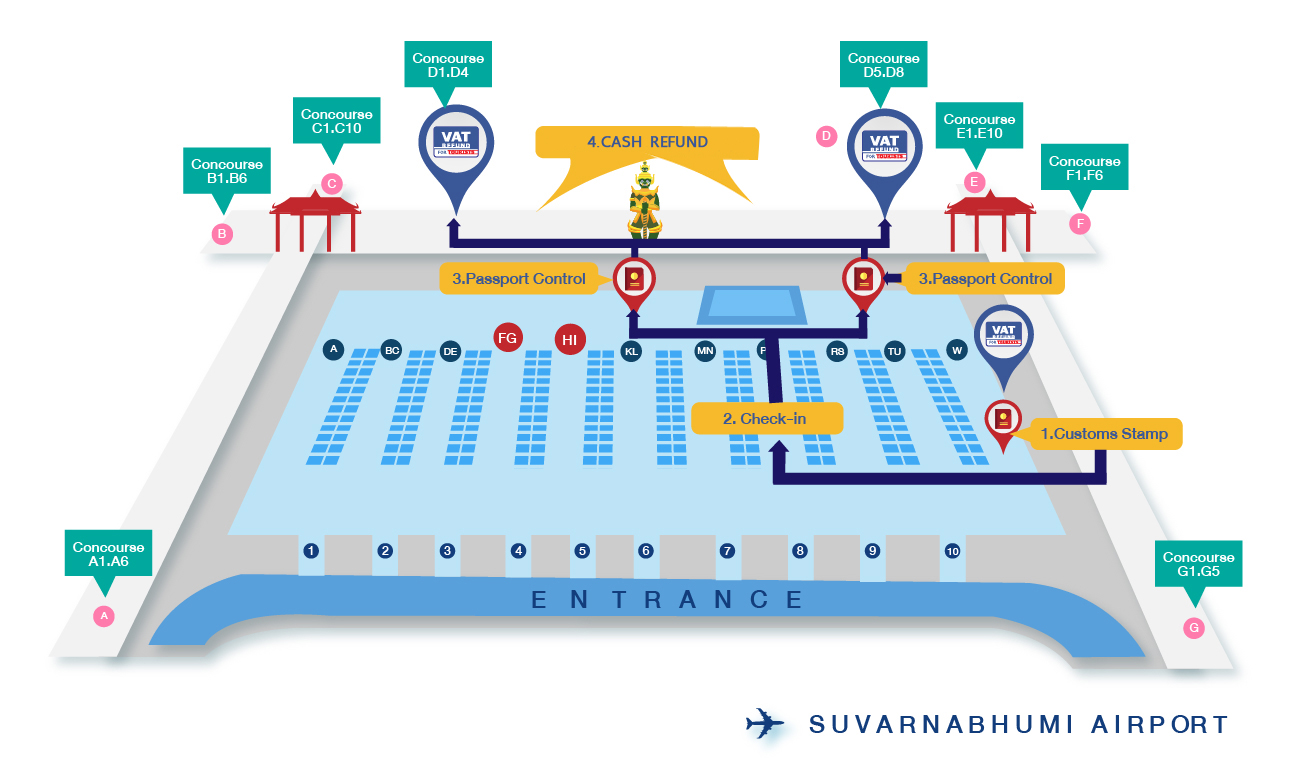

On your departure date, declare your purchased goods, P.P.10 Forms (or e-P.P.10), and original Tax Invoices at the Customs Office for inspection and stamps before checking in your luggage. Note: The departure date must be within 60 days from the date of purchase. For downtown VAT refunds, the timeframe is 14 days.

Goods value < 20,000 baht per person: No Customs inspection required. Proceed directly to the immigration checkpoint.

Goods value ≥ 20,000 baht per person: Present the goods, VAT Refund Application for Tourist form (P.P.10), and original Tax Invoice to the Customs officer at the Customs Inspection for VAT Refund Counter before checking in your luggage.

Luxury Goods: After Customs inspection, hand-carry luxury items (e.g., jewelry, watches, laptops, etc.) for a second inspection by Revenue officers at the VAT Refund for Tourist Office in the departure lounge after immigration. Luxury goods include items like jewelry, gold, watches, eyeglasses, pens, smartphones, laptops, handbags, or belts valued at 40,000 baht or more per item, or goods valued at 100,000 baht or more per item.

The VAT refund process depends on the refund amount and where you request it.

Refund ≤ 12,000 baht: Receive cash from downtown VAT refund agents. Note: Goods must be taken out of the country within 14 days of claiming.

Refund ≤ 30,000 baht: Receive via cash, credit/debit card (officers or VRT app), or WeChat/Alipay (VRT app). Refund > 30,000 baht: Only via credit/debit card (officers or VRT app).

Main Terminal, Floor: 4, Area: Public

24 Hours a day, 7 days a week